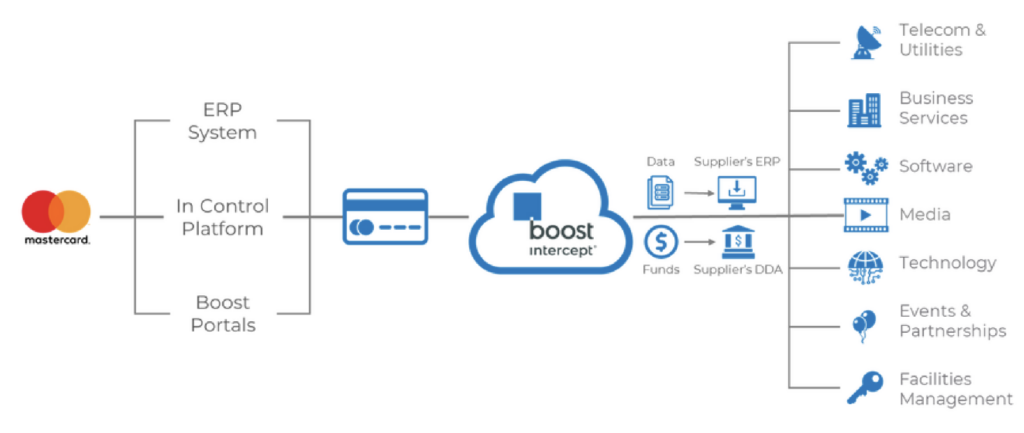

In a first of its kind alliance, Boost Payment Solutions (“Boost”) streamlined how Mastercard pays its suppliers worldwide with a one-stop-shop solution for optimized commercial card use and acceptance.

Corporations and their banks are looking to financial technology companies to improve B2B payments by curing the pain points associated with traditional payment methods. While check, wire and ACH remain the dominant payment methods in B2B, the landscape is shifting as a greater number of buyers and suppliers are turning to commercial cards. Many of today’s trading partners see cards as better-suited to complement complex trading terms. Virtual cards are quickly becoming the preferred method of commercial card issuance and acceptance. The rapidly accelerated need for digital solutions has driven significant increases in adoptions over the last two years and is expected to grow by more than 300% by 2026.

Mastercard has successfully migrated the vast majority of its payments to its commercial card platform. Mastercard now pays suppliers with its commercial card products via Boost in over 30 countries around the world.

Mastercard enjoys significant rebates and working capital generated by its card payment program.

Boost and Mastercard entered a strategic global partnership in 2021 to expand the use and acceptance of commercial cards around the world.

Raghu Adiraj

Vice President,

Commercial Acceptance

Raghu.Adiraju@mastercard.com

Download This Case Study

| Cookie | Duration | Description |

|---|---|---|

| __cfruid | session | Cloudflare sets this cookie to identify trusted web traffic. |

| ASP.NET_SessionId | session | Issued by Microsoft's ASP.NET Application, this cookie stores session data during a user's website visit. |

| CookieLawInfoConsent | 1 year | CookieYes sets this cookie to record the default button state of the corresponding category and the status of CCPA. It works only in coordination with the primary cookie. |

| OptanonConsent | 1 year | OneTrust sets this cookie to store details about the site's cookie category and check whether visitors have given or withdrawn consent from the use of each category. |

| viewed_cookie_policy | 1 year | The GDPR Cookie Consent plugin sets the cookie to store whether or not the user has consented to use cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| m | 1 year 1 month 4 days | No description available. |

| visitor_id492571 | 1 year 1 month 4 days | Description is currently not available. |

| visitor_id492571-hash | 1 year 1 month 4 days | Description is currently not available. |

| Cookie | Duration | Description |

|---|---|---|

| bcookie | 1 year | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser IDs. |

| bscookie | 1 year | LinkedIn sets this cookie to store performed actions on the website. |

| li_sugr | 3 months | LinkedIn sets this cookie to collect user behaviour data to optimise the website and make advertisements on the website more relevant. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| VISITOR_INFO1_LIVE | 5 months 27 days | YouTube sets this cookie to measure bandwidth, determining whether the user gets the new or old player interface. |

| YSC | session | Youtube sets this cookie to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 1 year 1 month 4 days | Google Analytics sets this cookie to calculate visitor, session and campaign data and track site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognise unique visitors. |

| _ga_* | 1 year 1 month 4 days | Google Analytics sets this cookie to store and count page views. |

| ai_session | 30 minutes | This is a unique anonymous session identifier cookie set by Microsoft Application Insights software to gather statistical usage and telemetry data for apps built on the Azure cloud platform. |

| ai_user | 1 year | Microsoft Azure sets this cookie as a unique user identifier cookie, enabling counting of the number of users accessing the application over time. |

| AnalyticsSyncHistory | 1 month | Linkedin set this cookie to store information about the time a sync took place with the lms_analytics cookie. |

| CONSENT | 2 years | YouTube sets this cookie via embedded YouTube videos and registers anonymous statistical data. |

| ln_or | 1 day | Linkedin sets this cookie to registers statistical data on users' behaviour on the website for internal analytics. |

| pardot | past | The pardot cookie is set while the visitor is logged in as a Pardot user. The cookie indicates an active session and is not used for tracking. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | Cloudflare set the cookie to support Cloudflare Bot Management. |

| elementor | never | The website's WordPress theme uses this cookie. It allows the website owner to implement or change the website's content in real-time. |

| li_gc | 5 months 27 days | Linkedin set this cookie for storing visitor's consent regarding using cookies for non-essential purposes. |

| Cookie | Duration | Description |

|---|---|---|

| _calendly_session | 21 days | Calendly, a Meeting Schedulers, sets this cookie to allow the meeting scheduler to function within the website and to add events into the visitor’s calendar. |